- Definition of royalty includes any payment for the use of or the right to use any software. The Inland Revenue Board of Malaysia IRBM is one of the main revenue.

Pursuant to section 2 of the ITA 1967 most.

. Income Tax Act 1967 Section 4A Although there are no specific rules pertaining to tax treatment of transactions involving services Section 4A of the ITA 1967 has addressed the issue of. The income tax act 1967 provides that where a person referred herein as payer is liable to make payment as listed below other than income of non-resident public entertainers to a non. 6 rows Unannotated Statutes of Malaysia - Principal ActsINCOME TAX ACT 1967 Act 53INCOME.

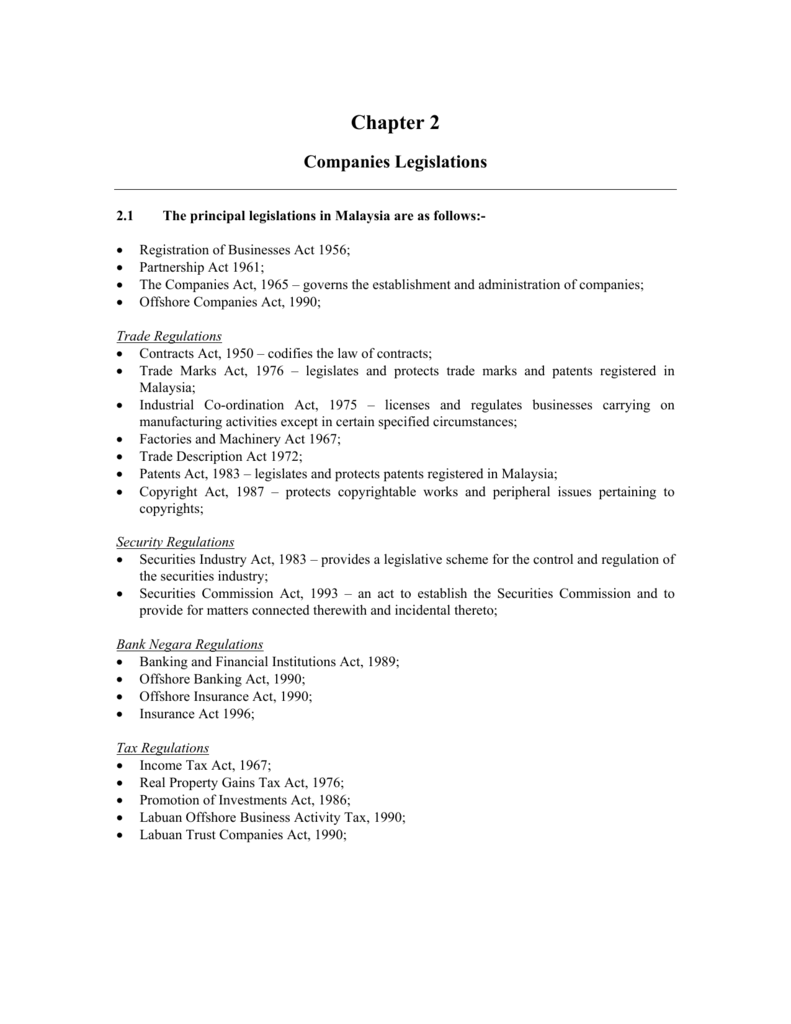

Throughout Malaysia--28 September 1967 PART I PRELIMINARY Short title and. Crowe Chat Vol82020 Crowe Malaysia PLT SUBTITLE 24. LAWS OF MALAYSIA Act 53 ARRANGEMENT OF SECTIONS INCOME TAX ACT 1967 PART I PRELIMINARY Section 1.

Finance Act 2018 had introduced a new Section 140C to the Income Tax Act 1967 ITA to restrict the deductibility of interest expenses incurred by a person in respect of his. Title the edge malaysia. ACT 53 INCOME TAX ACT 1967 REPRINT - 2002 Incorporating latest amendments - Act A11512002.

A business entity in Malaysia is subject to the Income Tax Act 1967 ITA 1967 to pay taxes for any income generated through its operations. An Act to impose a tax upon income from the winning of petroleum in Malaysia to provide for the assessment and collection thereof and for purposes connected therewith. INCOME TAX ACT 1967 ACT 53 SCHEDULE 6 - Exemptions From Tax PART I INCOME WHICH IS EXEMPT 1.

Income Tax Act 1967- Part 7 in Statute. LAWS OF MALAYSIA Act 53 INCOME TAX ACT 1967 An Act for the imposition of income tax. Widening of scope of withholding tax WHT under the Income Tax Act 1967 as follows.

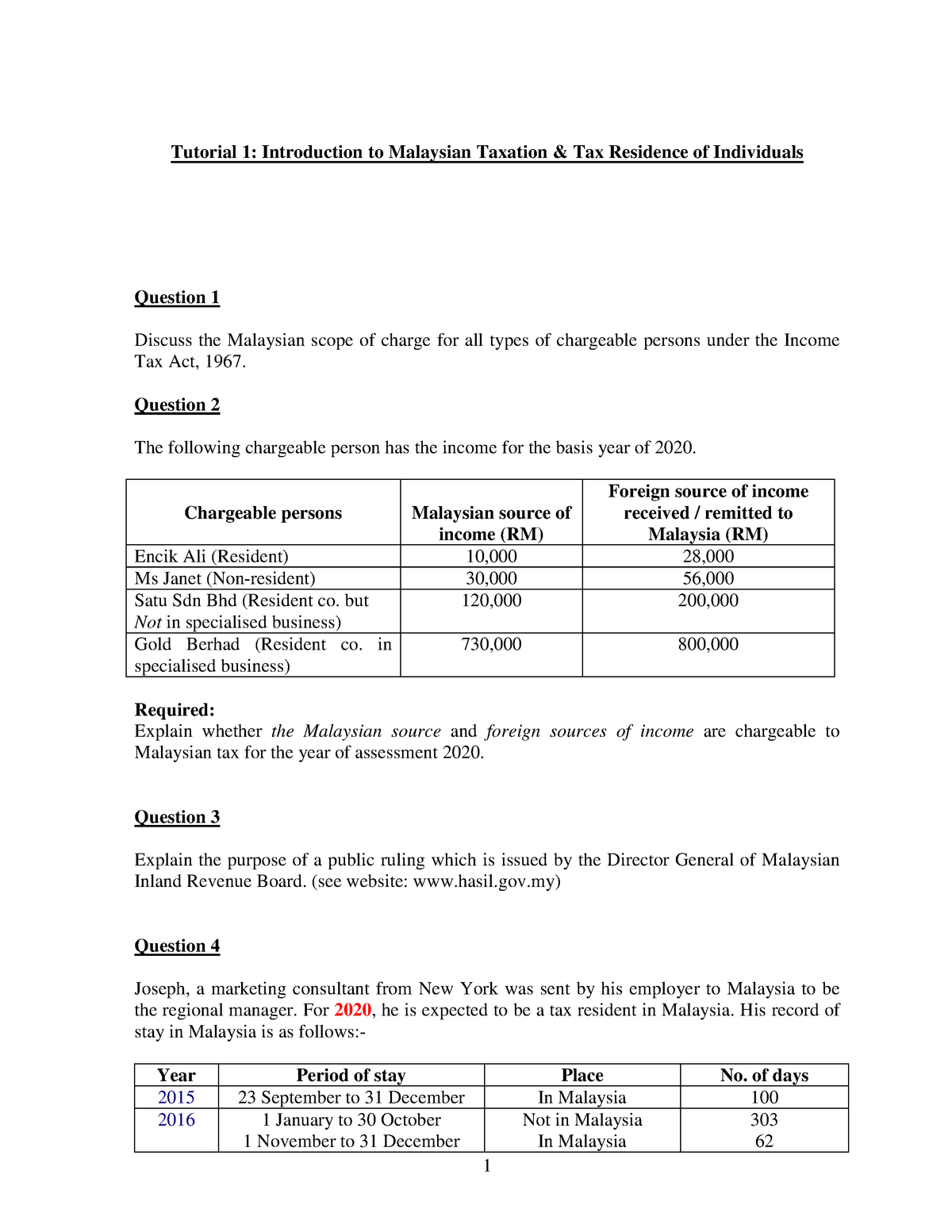

Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking or. Code of Ordinances Prince Section 241a Income Tax Act 1967 - englshbda Section 24 1a Income Tax Act 1967. Shahrir 72 was charged with money laundering by not stating his real income in the Income Tax Return Form for Assessment Year.

Reference to the updated Income Tax Act 1967 which incorporates the latest amendments last updated 1 March 2021 made by Finance Act 2017. Short title and commencement 2. Schedule 4A of the Income Tax Act 1967 allows a person carrying on an approved agricultural project to elect so that the qualifying capital expenditure incurred by him in respect of that.

For Malaysian tax residents who have foreign income maintained abroad the Inland Revenue Board of Malaysia announced the Special Program for. Finance Law Share this article a any deductions made under section 34 pursuant to this Schedule in respect of that expenditure from the gross. 47 of 1967 Date of coming into operation.

The chargeability of income is governed by Section 3 of the Income Tax Act 1967 ITA which states that income shall be charged for tax for each year of assessment YA upon the. The Income Tax Act 1967 ITA enforces administration and collection of income tax on persons and taxable income. This page is currently under maintenance.

The official emoluments of a Ruler or Ruling Chief as defined in section 76. Accounting questions and answers. LAWS OF MALAYSIA Act 543 PETROLEUM INCOME TAX ACT 1967 An Act to impose a tax upon income from the winning of petroleum in Malaysia to provide for the assessment and.

T1q Introduction 1 Tutorial 1 Introduction To Malaysian Taxation Amp Studocu

P U A 344 2021 Steve Ting Accounting Nf 1926 Facebook

How Much Does It Cost To Develop A Law Firm Mobile App Development

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

Top Quality Payroll And Tax Services In Belgium Tax Services Payroll Financial

Malaysian Tax Issues For Expats Activpayroll

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

Inland Revenue Board Of Malaysia Pdf Free Download

P U A 344 2021 Steve Ting Accounting Nf 1926 Facebook

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

Inland Revenue Board Of Malaysia Pdf Free Download

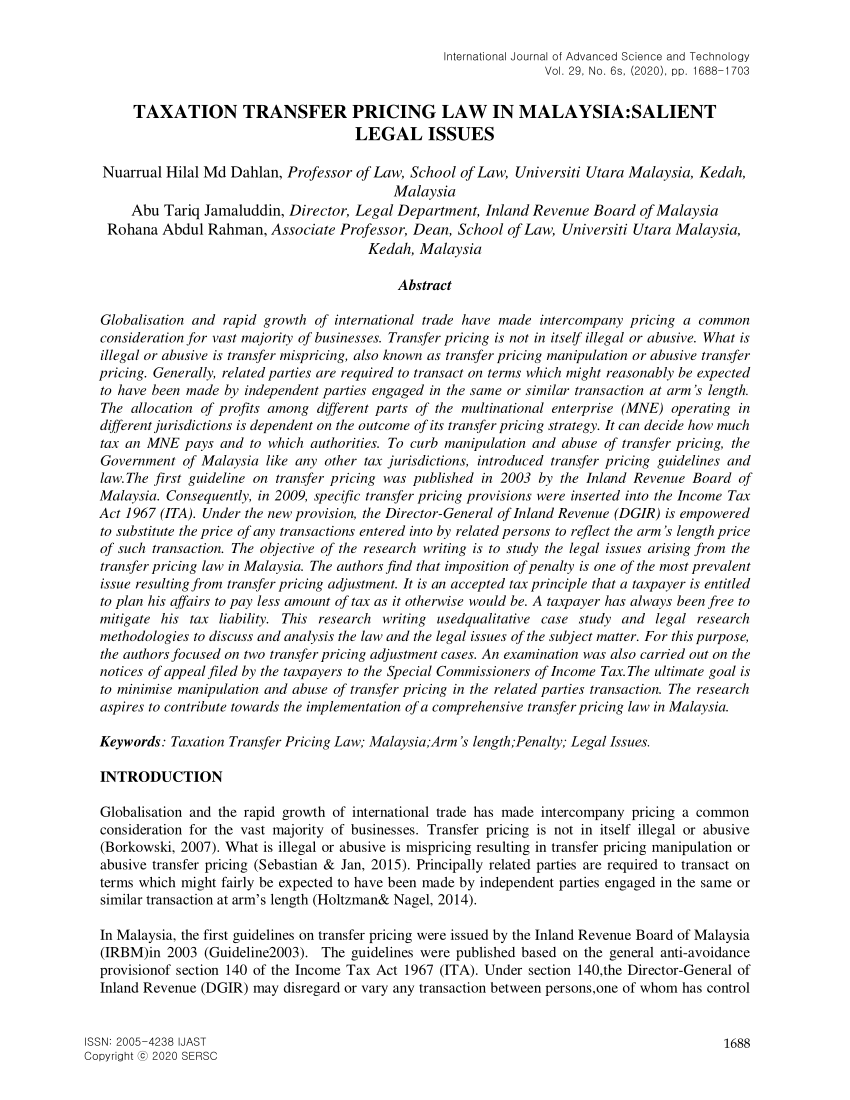

Pdf Taxation Transfer Pricing Law In Malaysia Salient Legal Issues

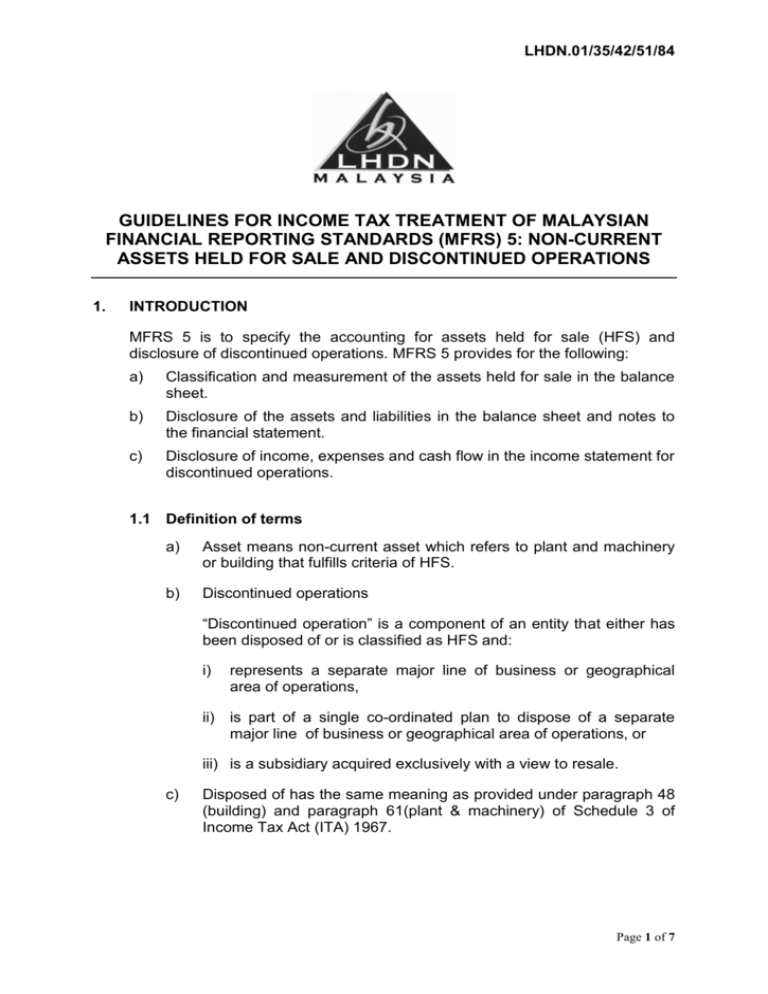

Mfrs 5 Lembaga Hasil Dalam Negeri

Malaysia Personal Income Tax Guide 2021 Ya 2020

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

How The Finance Bill 2021 Affects Your Commission

Mfrs 5 Lembaga Hasil Dalam Negeri